In August 2024, Ola Electric listed on the stock markets to much fanfare, and raised more than INR 5,500 Cr to invest towards future growth and building out its full electric vehicle stack. A few days after that, Bhavish Aggarwal outlined Ola Electric’s grand plans, — this is important as we will see later.

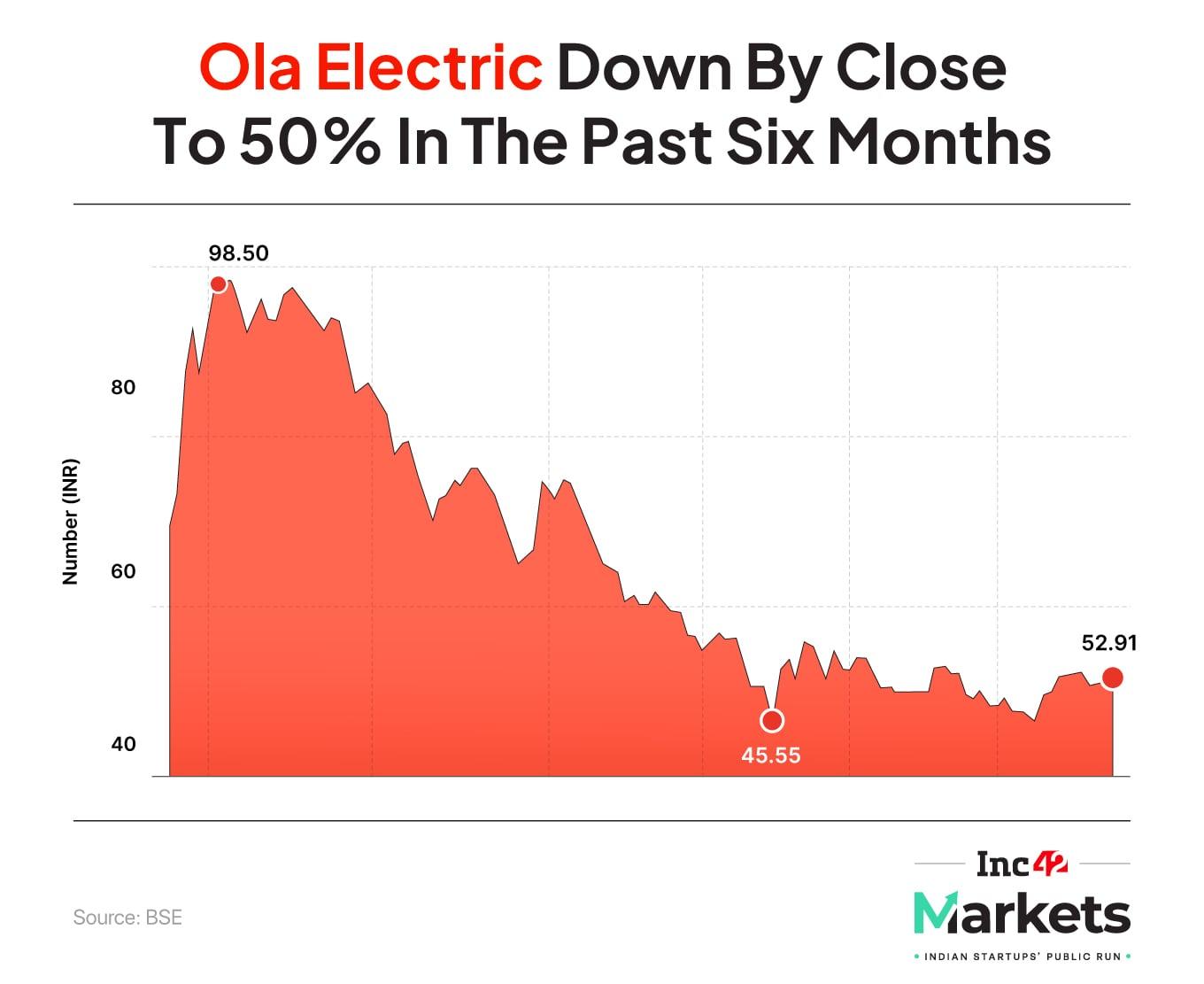

But not even a year after that IPO, Ola Electric is now , as it looks to get back on track after months of slow growth, mounting regulatory scrutiny over sales claims and a major dip in the stock price. The Bhavish Aggarwal-led company has also lost its top spot in the EV market.

According to data from the government-run Vahan portal, Ola Electric slipped from leadership position in the electric two-wheeler segment in April 2025 to TVS Motor. The Bengaluru-based company registered 19,709 vehicles last month, down 42% year-on-year with 21.46% market share.

Ola Electric’s Second Raise In 10 MonthsIn this current situation, Ola Electric’s board has approved the plans to raise through non-convertible debentures (NCDs) and other eligible debt securities. However, it did not disclose other specific details, including the intended use of proceeds.

So, what brings Ola Electric back to the fundraising table so soon after its massive IPO raise?

The answer to this is not clear. But what we can say is that Ola Electric has not even utilised the full proceeds from its IPO as of March 2025, according to ratings agency ICRA.

For one, more than half of the INR 5,500 Cr raised in the IPO has been left in fixed deposits and bank accounts, earning nearly INR 54 Cr in interest income for the company in 10 months.

Of the quantum raised, INR 1,200 Cr was specifically to be used for expanding the capacity of Ola Electric’s battery cell manufacturing plant from the initial test capacity of 1.4GWh to 5GWh by February 2025. The company claimed it would further increase capacity to 6.4GWh by April 2025.

ICRA that the commencement of commercial production is delayed. The project remains exposed to “risks of timely execution of subsequent expansion phases, demand/offtake, supply chain and technology obsolescence.”

This is a potential risk for Ola Electric. Under the production linked incentive scheme for cell manufacturing, the company is bound to increase operational capacity to 20GWh by the end of 2026. Failing this, it could lose out on its share of the INR 18,000 Cr PLI scheme.

Incidentally, Bhavish Aggarwal’s tall claims last August, soon after the IPO, included the ambition of building the world’s largest 100 GWh Gigafactory in India. Thus far, the company has struggled to come close to even 5% of this number. This is undoubtedly one of the biggest challenges for Ola Electric, given its emphasis on owning the full stack for EVs.

Ramping up the cell and battery manufacturing is key for Ola Electric, as the company’s plans to increase its profit per unit sold hinges on its in-house cells and batteries.

Taking all of this into account, ICRA has downgraded Ola Electric’s credit rating to BBB+ (NEGATIVE) from A (NEGATIVE) for short-term loans and bank guarantees, which does increase the risk for investors even for NCDs.

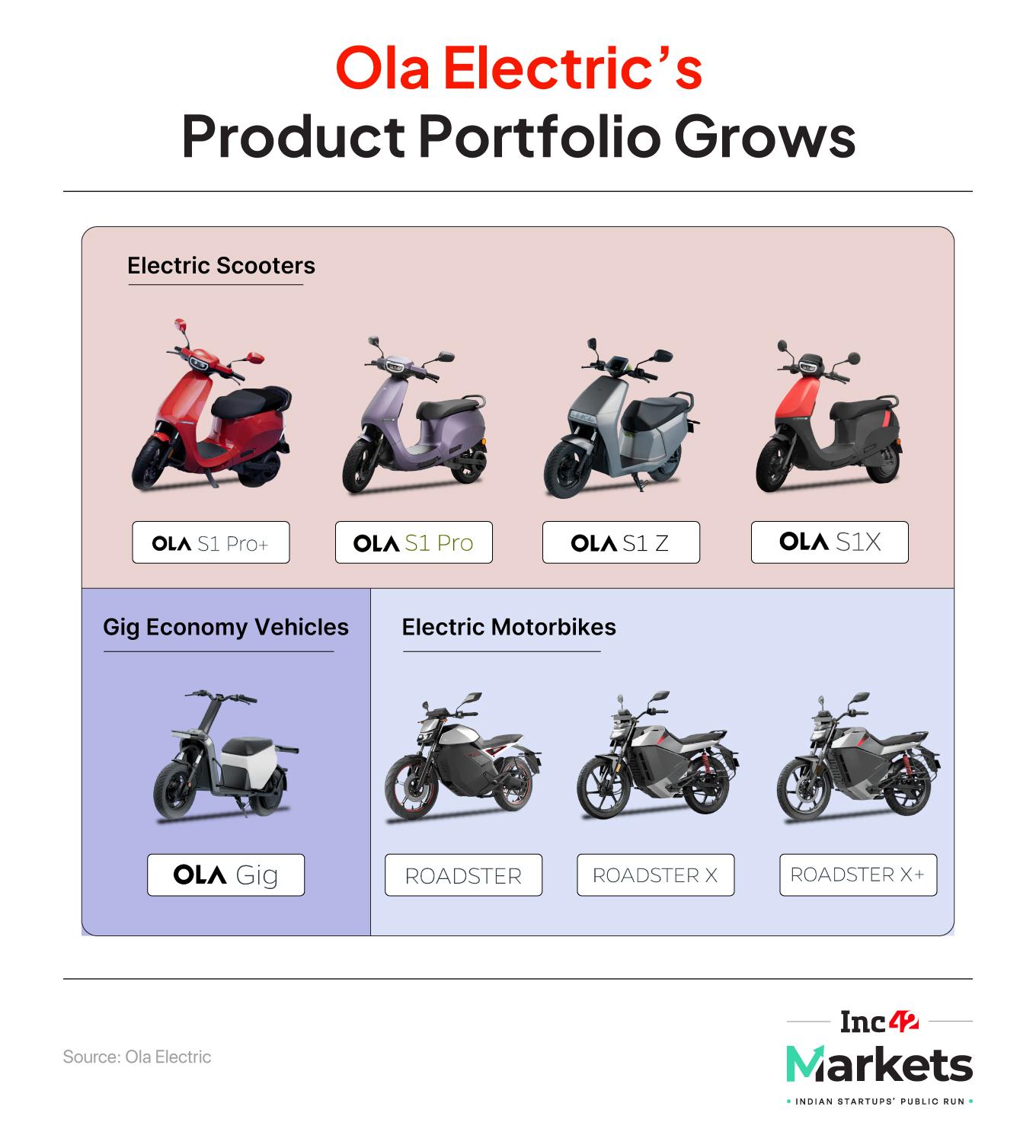

Ola’s Bikes Hit The RoadIncidentally, the timing of the fundraise coincides with Ola Electric’s of its Roadster motorcycles. The model had already , even though the deliveries have been delayed for two months.

In relation to its sales and distribution model, Ola Electric has been mired in a slew of controversies for allegedly operating more than 90% of its outlets without necessary trade certificates and.

The confusion emerged from the fact that Ola claimed that it sold over 25,000 electric two wheelers in February 2025, however the government’s VAHAN portal showed only about 8,600 registrations for the same period. Ola Electric had cited due to the termination of contracts with registration agencies as the reason for the mismatch.

Since March 2025, it has moved to an , and has shut all its regional warehouses across India. The EV maker now plans to leverage its 4,000 retail stores across the country to maintain vehicle inventory, spare parts, accessories, and last-mile deliveries.

Ola Electric expects its EBITDA margin to get a 10 percentage point boost, and roughly INR 30 Cr in monthly savings from this “redesigned” distribution network. It’s very likely that the company will have to rethink its distribution model going forward as it moves into new vehicle categories.

Incidentally, even as Ola Electric has lost some sales momentum in recent months, and as we wait for its Q4 numbers next week, its closest rival Ather Energy reported a 17% year-on-year drop in Q4 FY25 loss. Revenue grew by nearly 30% YoY to INR 676.1 Cr, driven by higher sales volumes and improved margins.

The EV market is also maturing with the emergence of newer players like River, Oben Electric and others, which are quickly gaining traction as well.

A second major fundraise so close to the IPO does raise questions about whether Ola Electric had accounted for the post-listing hiccups in its planning and roadmap. For Ola Electric, the next nine months will be highly critical as the company looks to meet its FY27 breakeven target, which is looking increasingly over-optimistic as of now.

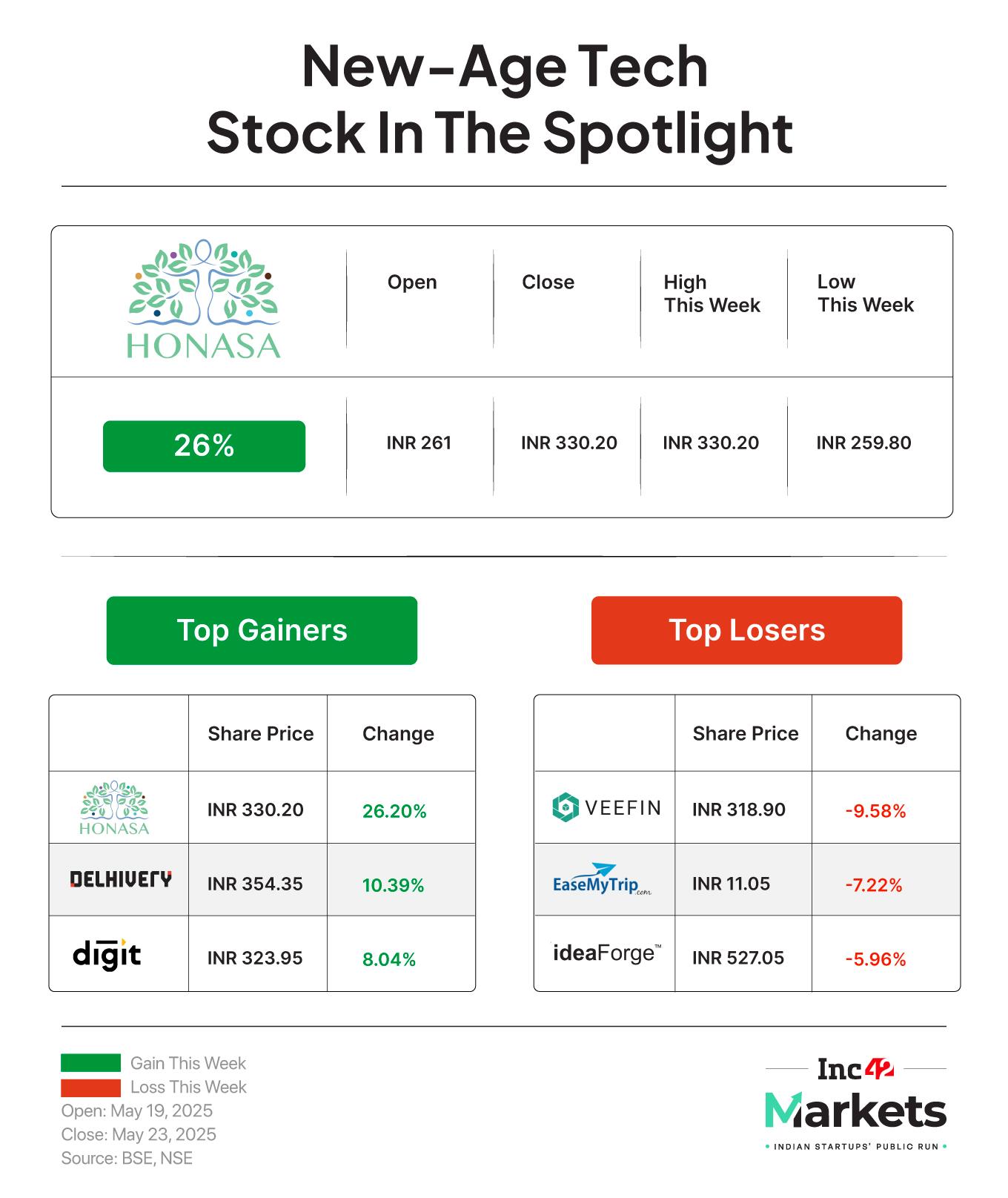

Honasa Shines BrightestMamaearth parent Honasa’s shares further soared by more than 25% this week to end at INR 330.20 on Friday, a day after the company reported a small bump in revenue (13.3%) to INR 533.6 Cr in Q4 FY25. However, Honasa’s bottomline suffered and profit declined by 18% to INR 25 Cr.

Incidentally, Honasa has been on a rally since the start of this year. The stock has gained 8% in value after losing over a third of its value in the past 52-week period. In large part, the investor faith has come as a result of Honasa’s long-term strategic bet to revamp its offline distribution model, which has been in the works since last year.

In FY25, the company had 1.2 Lakh unique outlets where its products were sold, compared to just 45,000 in Q1 FY25. More than anything, Honasa’s back-to-back quarters of profits after a drop into the red previously has enthused investors.

Markets Watch: New IPOs, Deals, Financials & More

- Global index provider FTSE Russell’s decision to cut Eternal’s investability weighting in its indices may lead to an outflow of INR 3,235 Cr from the stock, according to IIFL Capital.

- B2B travel tech company TBO Tek’s net profit surged 27% to INR 58.9 Cr in Q4 FY25 from INR 46.4 Cr in the year-ago period. On a sequential basis, the company’s bottom line grew 18% from INR 50 Cr.

- Logistics unicorn Shiprocket has pre-filed its draft red herring prospectus (DRHP), joining the long list of startups taking the confidential route, for its potential INR 2,500 Cr IPO.

- In preparation for its initial public offering (IPO), fintech unicorn Pine Labs has converted into a public company, and is weighing options for raising capital

The post appeared first on .

You may also like

"Will show real face of Pakistan to everyone": All party delegation member Ghulam Nabi Khatana

Government to go to war with banks using 'woke' rules to block defence funding

Gary Lineker hoped 'absolute shocker' in first Match of the Day appearance wouldn't air

Shoppers praise 'comfy' and 'flattering' Joe Browns floral midi dress that 'hides lumps and bumps'

Inside Amir Khan's lucrative new venture and his plans with President of Ghana's son