Back in 2018, when GenAI had yet to become the biggest buzzword in the tech industry, one of India’s major national banks, Bank of Baroda, launched an Analytics Centre of Excellence with a core focus on AI.

The CoE included a petabyte-scale enterprise data platform capable of handling structured, semi-structured, and unstructured data. It’s underpinned by production-grade data pipelines, integrated machine learning operations, and a governed data-science workbench.

The bank’s emphasis was clear — AI would be key to enhancing customer experience, improving operational efficiency, and data-driven decision making.

Bank of Baroda was not the only one. In fact, it was preceded by the likes of State Bank of India, India’s largest bank, which launched an AI-powered chatbot, SIA, in 2017.

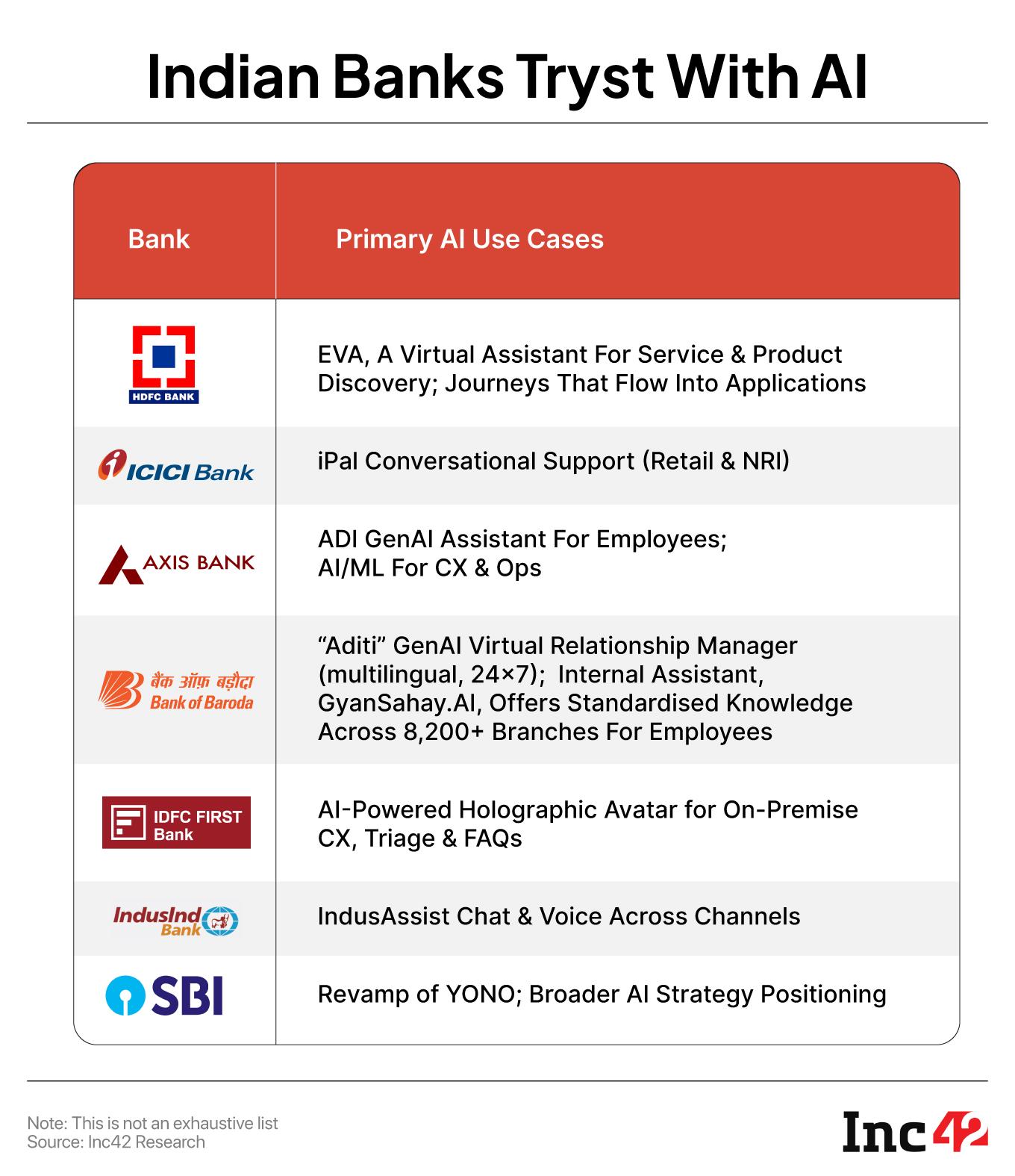

In the same year, HDFC Bank launched an AI chatbot named Electronic Virtual Assistant (EVA), while ICICI Bank followed suit with its chatbot, iPal, in 2018.

The past seven years have been about perfecting these experiments. But now, AI is moving the needle in a bigger way than ever before. Models have improved and have been trained on more relevant datasets; the proliferation of GenAI tools has reduced response time and increased accuracy. It’s also become indispensable in many internal cases and for customer-facing operations.

There’s also a realisation among the top rank and file at big banks that artificial intelligence is no longer discretionary; it is now a core requirement for success in banking and financial services.

As highlighted above, national banks such as SBI and Bank of Baroda have known how essential AI is for some time, but it’s the maturity of AI models and algorithms that have now created challenges. The early movers have already invested in their data foundation, services, and enabling architecture. But updating this for the modern age is another technology and talent-intensive task.

Can Indian banks stand up to this challenge?

Digital banking has been around since the internet, but these days the push is towards invisible banking — driven by machine learning, deep learning, and embedded APIs that quietly step in when needed.

Now, with large language models and generative AI, banking is getting even smarter and intelligent, bringing a higher degree of personalisation and unlocking new features such as advisories and money management.

It is expected that by 2030, Indian banking operations could see productivity improvements of up to 46% thanks to Generative AI, according to a report by EY India. This isn’t speculative. 74% of financial firms in India have already launched GenAI proof-of-concept projects, and 11% are in production deployments. Whether it’s voice bots, email automation, or risk analytics, banks are starting to scale and capture measurable value.

Analysts Inc42 spoke to noted that, although these are early days, the overall use case repository is already extensive. Some of the key areas where banks are experimenting with GenAI are sales and relationship growth, customer service, customer experience, documentation and automation, regulatory and compliance, decision support and business modelling, code development and more.

“The real challenge today lies in the rapidly evolving technology landscape, which can quickly create technical debt if not managed carefully. At the same time, successful adoption depends on end-user consumption and a clear value case,” said Bank of Baroda CTO Saurabh Shukla.

He added that the bank has built 60+ use cases across the banking value chain, spanning revenue, cost and risk. These tools help the bank increase its deposits by suggesting next-best action, enable cost optimisation, risk planning and fraud detection. This is in addition to automation for document processing and onboarding workflow, as well as chatbots for knowledge management and service delivery, which have become ubiquitous across the industry.

Another example is HDFC Bank, which recently invested in CoRover, making it one of first bank-backed investments in AI. Bank of Baroda’s Aditi and Axis Bank’s ADI are a few other examples of chatbots.

The ‘Real’ Struggles In GenAI ImplementationWhile chatbots have been around for years, AI is increasingly moving into day-to-day operations and taking centre-stage.

Having said that, implementation of AI in banking is still a largely unregulated area in India, and given the sensitive nature of the banking industry, there are several real-world challenges in the way.

Abhay Johorey, managing director at global business consulting provider Protiviti India Member Firm, noted that banks are conducting selective experiments with GenAI. Being a highly regulated industry, banks have to be more alert to the risk of hallucinations in large language models and chatbots. Banks have shown an appetite to adopt new tech, but they have to be ultra cautious about choosing AI-powered use cases.

Besides accuracy, data privacy is another hurdle in the way for banks before they can completely embrace GenAI.

Mahesh Ramamoorthy, CIO of YES BANK, supported this narrative. He believes that compliance is central to what a bank delivers, shaping both services and capabilities. As a result, YES BANK had to be cautious in selecting use cases. Internal deployment and testing was used to refine the controls and user experience.

“Before rolling out any process to customers, we focus on creating a strong internal footprint, whether through internal CRM-led AI models or experiments in various areas. For example, we experimented with accounts payables to automate invoice processing. Over time, regulators review these learnings to help us fine-tune processes and improve customer experience,” added the YES BANK exec.

This is where banks have to make several key decisions. The first one is build or buy.

Building Vs Buying AI For BankingFor most banks, a hybrid approach is better than either of these options.

In-house data scientists and AI engineers can develop the core capabilities and use-cases while collaborating with fintech players, tech giants and hyperscalers for expertise and certainty of delivery.

This ensures domain alignment and agility. Protiviti’s Johorey argues that Indian banks are at a nascent stage of GenAI development. At this foundational stage, even a small team of four or five people can effectively run an enterprise, particularly with the advent of agentic AI that can understand, execute, and even act autonomously.

While consultants or external partners can help accelerate progress, the ultimate goal should be to build, operate, and internalise these systems, as this capability forms the very foundation of future operations and will build accountability.

But banks that want to build AI in-house need to treat it as a continuum, choosing the right approach from analytics to ML to GenAI based on the use case.

This requires more than data scientists: it calls for data engineering and platform teams, strong governance and security functions, and cloud specialists who keep pace with evolving services. In the GenAI era, new skills like prompt engineering are also becoming essential. In short, a cross-functional operating model, blending domain expertise, engineering, governance, and next-gen AI skills, is critical to turn models into real business value.

Dealing with third-party AI players is also not easy. Bank of Baroda’s Shukla revealed that third-party AI needs to be an extension of the regulated banking stack, not a black box. Which is why contracts with banks come with hard requirements for explainability, fairness, security, and performance benchmarks.

Agreements govern clauses such as uptime, availability, system latency, accuracy and the likelihood of hallucinations.

Further, AI companies have to commit to model upkeep, periodic performance reviews, continuous monitoring, and time-bound remediation. All bank-level tech is audited and captured in service reports.

The Cost-Benefit Question“As part of the build and assessment, we require metrics that demonstrate predictive power, evidence of bias mitigation, and documented security controls,” Bank of Baroda’s CTO Shukla added.

With revenue pressure growing on AI companies, enterprise customers are being squeezed on costs pertaining to AI. While there are measurable improvements in productivity through AI, does the cost justify it?

YES BANK’s Ramamoorthy notes that AI investment as a percentage of overall costs typically ranges from 2% to 10%. This depends on the organisational level and the maturity of innovation capabilities. As technology matures, outcomes become more accurate while input costs decline, strengthening the business case.

Here, a key challenge lies in identifying the right metrics to guide future investments, as results often materialise only in the long term. As usual AI investment decisions are guided by cost–benefit analysis, operational efficacy, and outcome accuracy, with focus areas including:

- Repeatable tasks suitable for GenAI-driven automation

- Customer behavior and service patterns for personalised, predictive insights

- Regulatory and compliance requirements to strengthen risk management

- Operational bottlenecks and cost structures to reduce errors and turnaround times

By tracking these signals, banks aim to balance innovation with governance, unlocking value while safeguarding resilience and trust.

Avoiding The Pilot Trap“I think evaluation criteria depend on the specific use case. Each generative AI capability has its own template — what it should generate, how efficiencies are measured, and what data quality is required. There’s no one-size-fits-all; it’s a combination of factors that guides prioritisation and investment,” added Ramamoorthy.

Scaling AI beyond pilots requires a careful combination of governance, team structure, and management engagement. First, it is crucial to establish a clear governance model that defines not only how AI is implemented, but also how its use is tracked across security, data, and compliance frameworks. This holistic approach ensures that AI projects align with regulatory requirements and organizational standards.

The bank leaders we spoke to believe management buy-in is equally important. Leaders need to understand the value being generated, support the teams, and intervene when necessary to maintain progress. Metrics and outcomes — whether for internal development or external partnerships—should be carefully measured and calibrated to provide actionable insights.

Early proof-of-concept projects have provided valuable learnings. Banks can now assess whether use cases comply with data privacy standards, adhere to security frameworks, maintain model governance, and clearly define partner roles. By bringing these lessons into open, structured discussions, organisations can avoid repeating mistakes, improve processes, and create consistency in rolling out AI at scale.

“A lot of these learnings, once you bring them on the table as an honest conversation, help us feed them back into the process and improve how we implement capabilities going forward,” said Ramamoorthy.

GenAI: Shaping The Future Of Indian Banking

GenAI: Shaping The Future Of Indian Banking Our conversations with banking industry leaders and technologists have made it clear that the next decade in banking is going to look very different.

Analysts expect the structure of financial markets to shift with more granular regulations for AI in the BFSI domain.

Risk management is expected to be one of the biggest game changers in the next five to six years. AI can help manage operational, credit, and tech risks more efficiently, while also supporting regulatory compliance.

Along with operations, banking roles will also evolve, and reskilling won’t just be an option. New talent might well be needed for banks to adapt to the AI age. In lieu of that, banks could rely on structured training, in-house academies, partnerships with educational institutes and startups.

But there’s no denying that despite the enthusiasm among the Indian banking ecosystem, banks are only at the start of their AI journey.

Early results are promising, bankers say, but this technology needs time and fine-tuning to deliver real value. Many believe the bigger shift will come when banks start building their own models, rather than relying on global ones, and when they go beyond the rudimentary use-cases.

The post Indian Banks And The GenAI Quandary appeared first on Inc42 Media.

You may also like

Is Mizkif single? Relationship status of the Twicth streamer before and after the Emiru controversy

'California is my home, we wouldn't leave if..': Sam Altman on OpenAI's deal with the state

Nigel Farage tears apart Keir Starmer over migrant crisis

Sydney Sweeney grilled on social media for hinting at playing James Bond: 'You're a woman, so no'

Who is in the cast of The Asset on Netflix?