Mumbai: Spending on credit cards and fresh card additions hit record highs in September, central bank data showed, reflecting the combined impact of festivals and the biggest across-the-board cuts in producer taxes on domestic consumption.

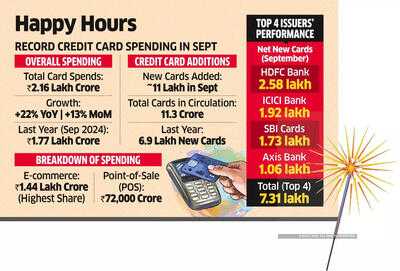

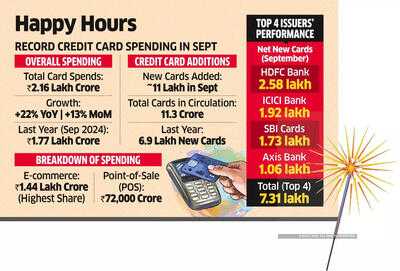

Total monthly card spends crossed ₹2.16 lakh crore, translating into on-year growth of 22% and sequential growth of 13%. Credit card spends had clocked ₹1.77 lakh crore in the same month last year.

Spending on e-commerce websites was the highest - at more than ₹1.44 lakh crore. Spending through point-of-sale devices was more than ₹72,000 crore.

"The surge in high-ticket festive purchases through credit cards reflects a growing affinity towards value and convenience," said Santosh Agarwal, CEO, Paisabazaar. "Consumers are using credit cards more strategically, timing their big-ticket buys to coincide with festive season deals and card-specific rewards."

From September 22, prices of consumption goods across the spectrum were drastically reduced after the Centre slashed GST slabs, and brought most items to lower GST bands.

From September 22, prices of consumption goods across the spectrum were drastically reduced after the Centre slashed GST slabs, and brought most items to lower GST bands.

Meanwhile, fresh credit card additions neared 1.1 million in September, taking the total credit card tally to 113.3 million. In the same month last year, less than 700,000 cards were added. Credit card spending, which was growing at a tepid pace, gathered momentum in September and is expected to quicken in October aided by the onset of the festive season, attractive e-commerce discounts and retailer-led promotional campaigns, which typically drive a surge in discretionary purchases.

Total monthly card spends crossed ₹2.16 lakh crore, translating into on-year growth of 22% and sequential growth of 13%. Credit card spends had clocked ₹1.77 lakh crore in the same month last year.

Spending on e-commerce websites was the highest - at more than ₹1.44 lakh crore. Spending through point-of-sale devices was more than ₹72,000 crore.

"The surge in high-ticket festive purchases through credit cards reflects a growing affinity towards value and convenience," said Santosh Agarwal, CEO, Paisabazaar. "Consumers are using credit cards more strategically, timing their big-ticket buys to coincide with festive season deals and card-specific rewards."

From September 22, prices of consumption goods across the spectrum were drastically reduced after the Centre slashed GST slabs, and brought most items to lower GST bands.

From September 22, prices of consumption goods across the spectrum were drastically reduced after the Centre slashed GST slabs, and brought most items to lower GST bands. Meanwhile, fresh credit card additions neared 1.1 million in September, taking the total credit card tally to 113.3 million. In the same month last year, less than 700,000 cards were added. Credit card spending, which was growing at a tepid pace, gathered momentum in September and is expected to quicken in October aided by the onset of the festive season, attractive e-commerce discounts and retailer-led promotional campaigns, which typically drive a surge in discretionary purchases.

You may also like

J&K MLAs, Mirwaiz appeal for a kinder view on separatist Shah, Kashmiri prisoners

UAE finalises sugar-tax ratesfor sweetened drinks, sets 0% rate for artificial sweeteners

Cyclone Montha triggers deluge in parts of Telangana, hits road and rail traffic

Tennis Premier League announces TPL Race to Gold Masters tournaments 2025

Full list of the best 100 pubs in the UK - check your local